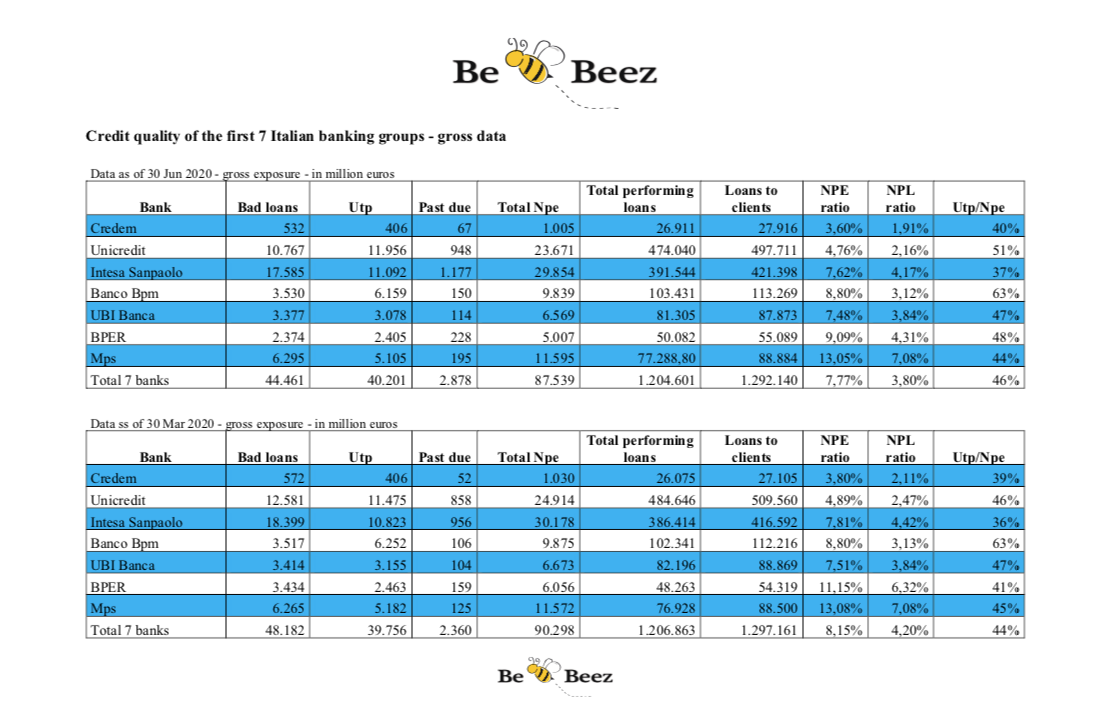

There were 87.5 billion euros in gross impaired loans on the balance sheets of the first seven Italian banking groups at the end of June 2020, down from 90.3 billion euros at the end of March, with 40.2 billion euros in Utp loans (from 39. . .

THIS IS PREMIUM CONTENT

Subscribe to read the entire article.

Have an account?

Please to read the whole article.