Despite summer weather, Italian private debt and NPL markets don’t slow their activity.

Despite summer weather, Italian private debt and NPL markets don’t slow their activity.

Project Ace, a portfolio of NPLs worth 3.5 billion of euros that Banco Bpm is selling together with a stake in the platform for handling problematic credits, has attracted the interest of five suitors (see here a previous post by BeBeez). The list of potential buyers includes doBank, Credito Fondiario, Prelios (which belongs to Davidson Kempner Capital Management), Guber Banca (Varde Partners has a stake in the firm) and the allied bidders Christofferson Robb & Co-Spaxs-Fire. On another front, Banco Bpm completed the securitisation of Project Exodus, a portfolio of Npls worth 5.1 billion, through Red Sea SPV (see here a previous post by BeBeez). Red Sea issued three classes of shares: senior securities backed by GACS for 1.66 billion, or 32.5% of the nominal value, with rating Baa2 and BBB (Moody’s and Scope Ratings) paying a coupon of 6 months Euribor plus 60 basis points; mezzanine and junior securities worth 152.9 million and 51 million. Once completed Project Exodus, Banco Bpm will have sold 75% of its problematic credits.

B2 Kapital, part of listed Norwegian firm B2 Holding, is buying a portfolio with a gross value of 245.7 million of euros from Zagrebacka banka, a Croatian subsidiary of Unicredit (see here a previous post by BeBeez). The parties may sing a closing by the end of July 2018.

Intesa SanPaolo is considering the sale of Progetto Levante, a portfolio of UTP credits worth 250 million of euros (see here a previous post by BeBeez). Intesa is also working on the securitisation of a portfolio of Npls with a gross value of 10.8 billion, 60% of which will be a senior tranche. A special purpose vehicle that will belong to Intrum (51%) and Intesa SanPaolo (49%) will buy the remaining 40% of the securitised portfolio split between a junior and a mezzanine tranche. US asset manager CarVal Investors will buy 20% of Intrum’s stake in the SPV.

Credito Valtellinese launched Project Aragorn, the securitisation of a portfolio of secured NPLs worth 1.6 billion of euros (see here a previous post by BeBeez). Aragorn issued three classes of ABS: a senior tranche of 509.5 million backed by Gacs; a mezzanine tranche with investment rating of 66.8 million; a junior tranche of 10 million.

Bain Capital Credit acquired a portfolio of NPLs with a gross value of 100 million from Alba Leasing (see here aprevious post by BeBeez). Kpmg and Studio Chiomenti acted as financial and legal advisor to Alba Leasing. Bain Capital Credit hired Etna Advisors and Gitti & Partners for strategic and legal counsel.

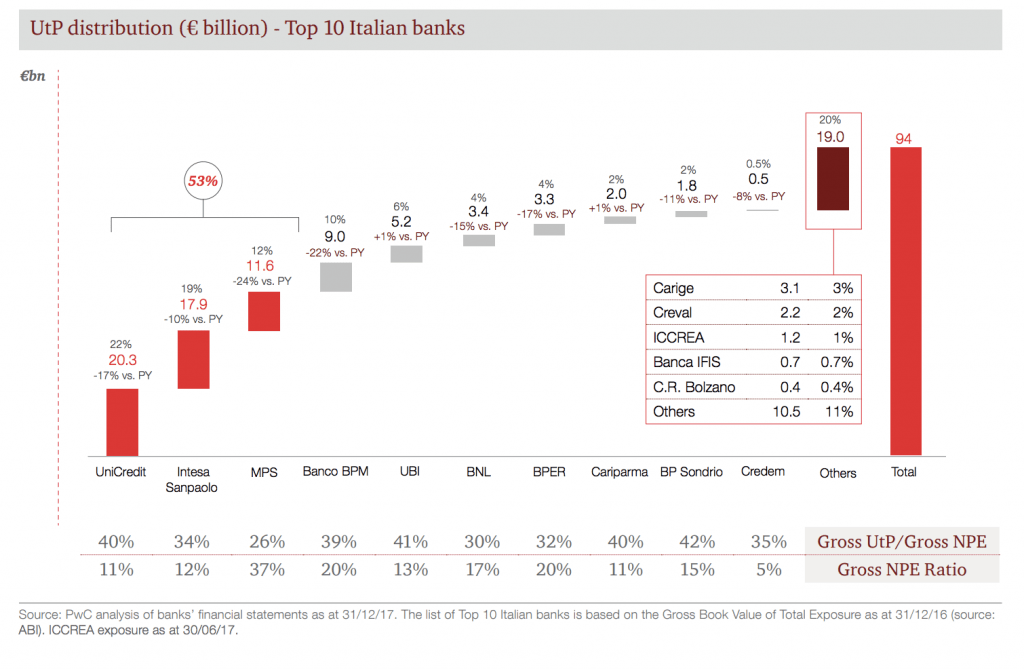

According to a report of PwC, Italian banks are offloading their UTPs and NPLs at a steady pace (see here a previous post by BeBeez). Challenger banks will keep this trend robust. These firms may offer solutions and integrated services for specialty finance and servicing. Guber Banca, a firm that belongs to fund Varde, and listed Banca Interprovincialemake an example of this business model.

On the private debt side, Italian media company Alma Media, owner and publisher of magazines and tv channels Alice, Marcopolo, and Case Design Stili, listed on Milan ExtraMot Pro a minibond of 1.85 million of euros di minibond (see here a previous post byBeBeez). The liability is the first tranche of a 5 million issuance and will mature on December 2019 and pay a 5.5% coupon. Alma Media is developing Pop Economy, a multichannel for finance and economics. The company has revenues of 12.7 million and an ebitda of 0.7 million with net financial debt of 0.19 million.The company belongs to private shareholders and Malta-based Abalone Asset Management (62.83%), Daleth Partners (20%), LT Holdings(10%). Alma will invest such proceeds for organically developing the business.