Timone Fiduciaria srl, the holding company which gathers the shareholders adhering to the Azimut Holding spa shareholders’ agreement, will raise its stake in Azimut’s capital to 24.2% thanks to injections of new capital by Azimut’s managers and by Peninsula Capital (see here the press release).

The deal was well expected by the market (see here a previous post by BeBeez). Azimut actually had published a press release by Timone Fiduciaria last May 22nd, following previous press releases on January 15th, March 8th and May 10th, all speaking about a possible strenghtening of Timone Fiduciaria’s stake in Azimut Holding villa a maximum of 25%.

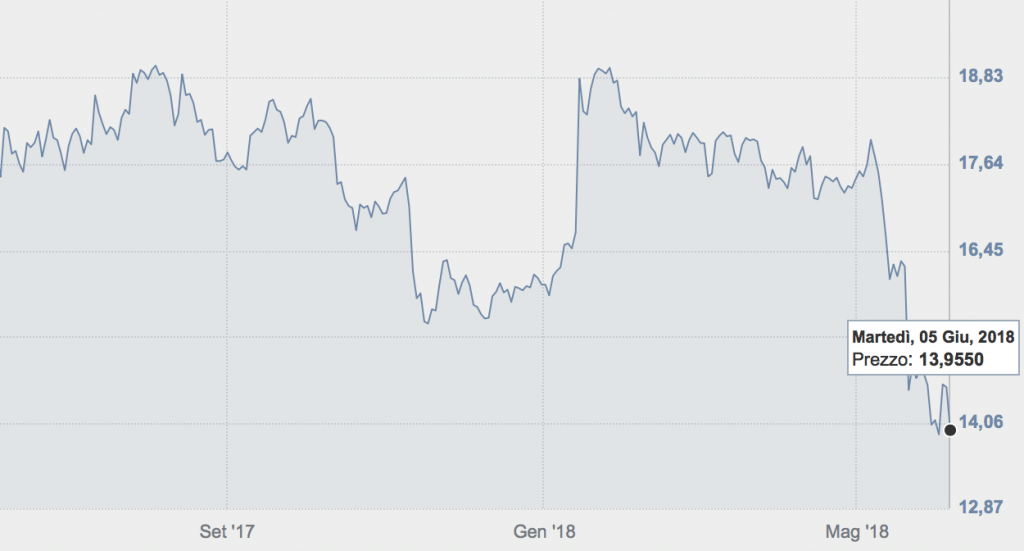

More in detail, Timone Fiduciaria said that 1206 members of the Agreement have bought about 7 million ordinary shares of Azimut, equal to 5% of share capital net of treasury shares (4.9% of total share capital). The shares acquired in the transaction were bought at an average price of 14.37 euro per share for a total value of about 100 million euro. The overall amount collected from the management, financial advisors, portfolio managers and employees of the group is equal to 77 millions. The transaction was joined by 16 top managers, for an overall amount of about 30 million euros, amongst whom the Chairman Pietro Giuliani with an overall investment of more than 26 millions.

As for Peninsula, its investment vecchie Peninsula Investments II sca will participate in the transaction, and will therefore become a member of the Agreement. More precisely, Peninsula will enter into a pre-paid forward transaction with Goldman Sachs International entailing the acquisition at settlement of about 3.8 million ordinary Azimut shares, equal to 2.8% for a total value of about 55 million euros.

Thanks to those two deals, the whole state owned by Timone Fiduciaria Will be raised from 16.4% to 24.2% of share capital net of treasury shares (or from 15.8% to 23.3% of total share capital). Peninsula will then become the first institutional investor in the Shareholders’ agreement, reaching a potential stake of more than 10% of the shares owned by Timone.

The transaction, for what regards the original members of the Agreement, was supported by a financing for 50 million euros in favour of Timone Fiduciaria secured by way of a pledge on the shares acquired by Timone under the transaction and by a cash collateral. The latter is remunerated by the funded members, and is provided for by some of the participants who joined the transaction for a total amount of 25 million euros, of which Mr. Pietro Giuliani contributed about 23.4 millions. The loan and the relative securities have a duration of 3 years with options of early termination in line with market practices.

Nomura advised Timone Fiduciaria as Financial Advisor while Intermonte supported Timone Fiduciaria in Purchasing the shares on the market.Timone Fiduciaria was also supported by Latham & Watkins and AC Firm law firms. Peninsula was advised by RCC and Van Campen Liem law firms. The lending bank was supported by Studio Legale Gitti and Partners law firm.

Mr. Giuliani said: “Three years ago, with the sale of Azimut shares by many founding Partners, we started a path that today reached an important milestone: we’ve come back to the same percentage ownership that Timone had back in 2015, though fully reinstated in favour of new Italian and international colleagues. (…) Personally, I have invested today in the Company almost the totality of the proceeds I generated (net of taxes) three years ago, convinced more than ever in its future”.

The Italian Stock Exchange yesterday didn’t celebrate the deal as Azimut stock closed at 13.955 euros or more than 4% down from Monday. Azimut’s market capitalization still remains over 2,076 billion euros.

This is a great come back to private equity investors for Azimut, as the asset management comnpany was listed on the Italian Stock Exchange in 2004 by private equity investor, Apax Partners, who had supported Azimut’s management buyout in 2002, led by Mr. Giuliani. The seller than was former italian banking group Bipop-Carire.